Sustainability Governance Scorecard

We conducted an impact-focused research aiming for a better world through measurement and mutual learning. With our shared goal of a "more sustainable future," we have developed a model that companies can use as a developmental tool: the Sustainability Governance Scorecard©.

In the model we have developed, we examine the governance quality of sustainability efforts in four fundamental dimensions: board guidance, practices, board oversight, and continuous learning. Each of these dimensions is evaluated using objective criteria developed through a governance lens. Sustainability governance is directly related to the guidance provided by the board of directors. When thinking of a company as a ship, the board of directors is the captain of that ship. The ability of a ship to follow the right course and reach the correct port depends on the captain steering the helm at the right angle. The situation is not much different for companies. The board of directors determines the destination the company will pursue. If the board of directors provides proper guidance and sets the right goals for the company, the correct progression of ongoing processes becomes inevitable. In the initial stage of our developed model, we examine the guidance provided by the board of directors regarding sustainability.

What are the key elements for determining the right course for a company in terms of sustainability?

In our model, we have defined the following criteria for the guidance that the board of directors should provide:

- Values, strategies, company policies, charters and/or principles

- The place of sustainability-related issues and ESG factors in company strategies

- The coverage of human rights, labor rights, environment, society, health and safety, and other related topics in the guidance

- Board composition and diversity

- Stakeholder mapping and engagement

- Reviewing the board's materiality matrix

- Geographical inclusiveness, coverage of the entire value chain including the impacts throughout the life cycles of products and the supply chain

- Identification of key performance indicators and integrating these indicators into executive compensation and incentive mechanisms

- Setting future goals for sustainability performance

The second fundamental area that influences the quality of sustainability governance is the company's implementation processes. Just as even if the captain determines the right course on a ship, the quality of the journey depends on factors such as the crew's performance and timely control of the wind, the same applies to companies. The quality of implementation for a company, just like the quality of a ship's journey, depends on various factors. Some of these factors include:

- Sharing significant performance outcomes related to environmental, social, and governance aspects

- Scope of charters, supply chain, audits, internal control mechanisms, incentives, and development initiatives

- Determination and sharing of executive compensation and bonuses, inclusion of environmental, social, and governance-related issues in criteria for compensation and bonuses

- Risk management

- Stakeholder engagement

The Sustainability Governance Scorecard© examines the establishment and monitoring of a compatible implementation structure with sustainability principles.

How can the board of directors oversee sustainability efforts?

In the Sustainability Governance Scorecard©, the board of directors' oversight responsibilities are defined through the following elements:

- Identifying critical oversight points regarding environmental, social, and governance aspects

- Assessing performance related to environmental, social, and governance issues

- Incorporating incentive mechanisms into key performance indicators related to environmental, social, and governance aspects

- Inclusion of sustainability sub-domains in internal audit mechanisms and independent audit processes and ensuring regular review of these audits

All these processes should establish and support a continuous learning environment within the organization. When a continuous learning environment is embraced as a culture within the company, the quality of the company's sustainability governance will also increase. It enhances the next journey of the ship while developing this mutual learning environment. The Sustainability Governance Scorecard© defines a continuous learning culture within the organization with the following criteria:

- Allocation of resources for development and improvement

- Comparative evaluation with peers

- Incorporating the learning process into orientation, training, promotion, incentive processes, etc., and adopting a corporate development approach

In general, the Sustainability Governance Scorecard© defines and utilizes concrete, measurable, and objective criteria for sustainability governance. The foundations of this methodology are based on the LOGIC and DSICS approaches. Similar to the LOGIC and DSICS approaches, the Sustainability Governance Scorecard Model© is also based on determining the right direction, measuring the right indicators, evaluating the results, and learning from the outcomes and counterparts.

Our Publications

Sustainability reporting is an evolving field, improving every year as more companies adopt good practices and increase transparency regarding their sustainability performance. As such, we as well re-evaluate our methodology and criteria set to reflect these developments each year.

To move towards a more sustainable future, we need to have organizations that assume their sustainability responsibilities and take action.

Sustainability is critical not only for the livelihood of the humanity and the planet, but also for the long-term success of the corporation.

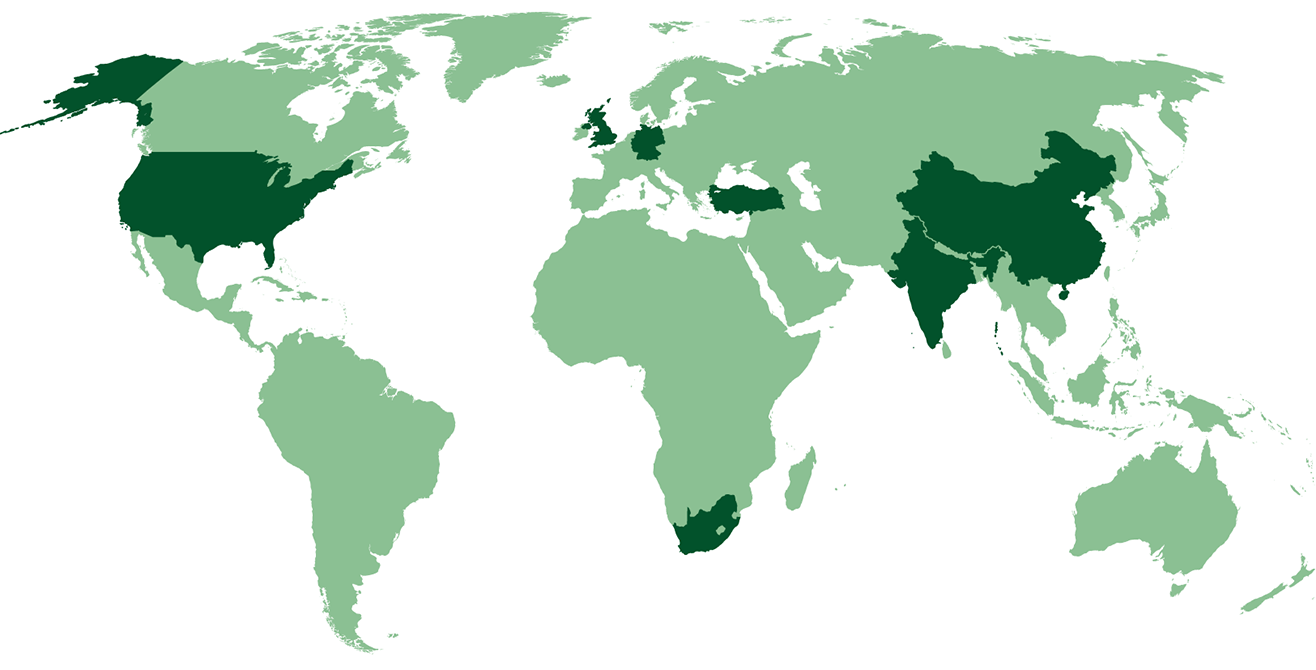

Not only identifies and provides information about the state of the Global Sustainability Leaders, but also highlights good examples from which the world could learn.